Topic report card

Read a two-page summary of the Energy consumption topic (PDF 315KB).

Overview

Energy underpins every aspect of our daily lives.

It’s what we use when we turn on a light, when we cook a meal, when we drive our car. It’s also what manufacturers need to run the equipment that makes products.

Because we’re always using energy, we need to keep track of how much we use, what sources it’s coming from and how these change over time.

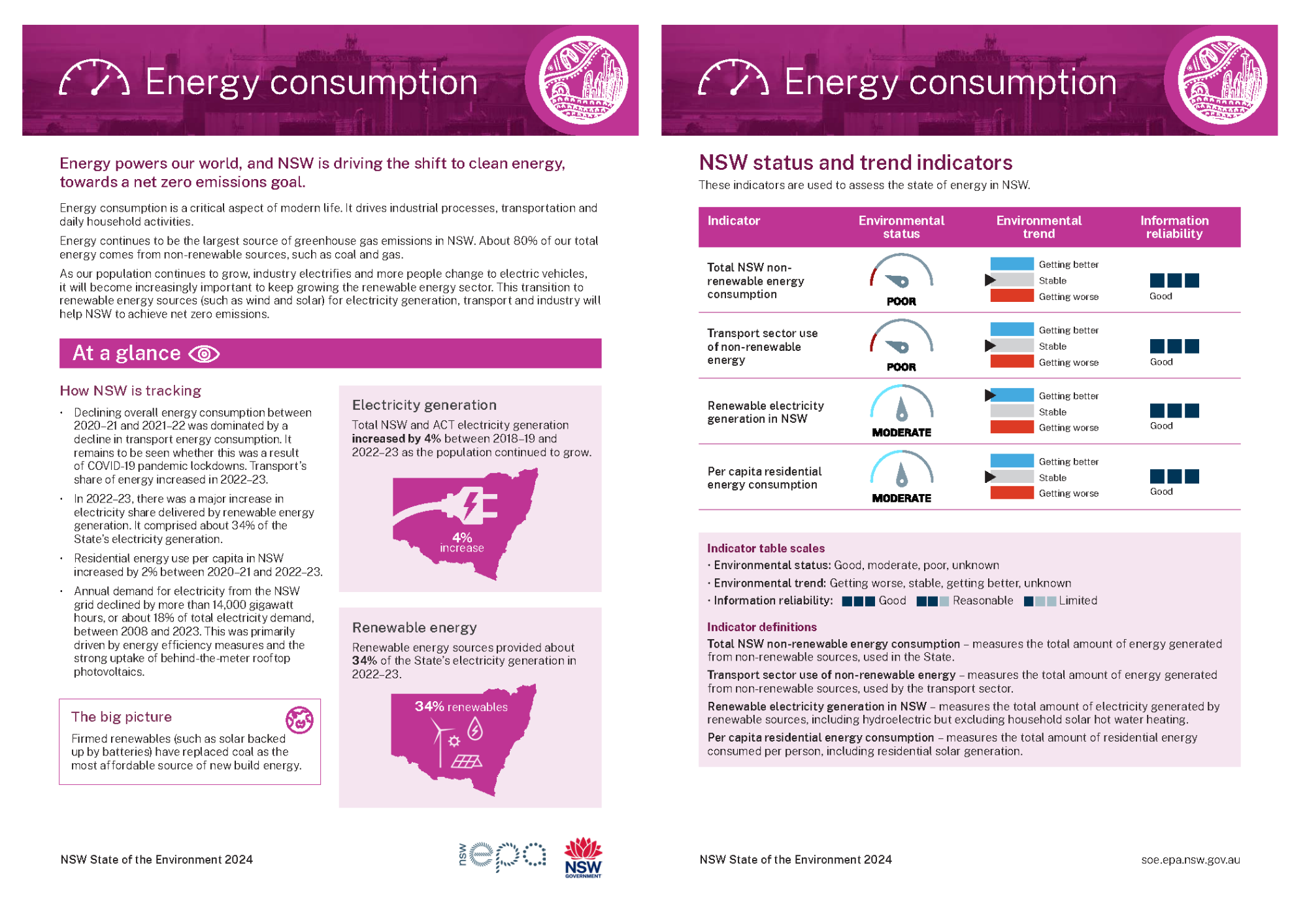

Energy consumption for NSW is measured in petajoules (see Image P1.1). One petajoule (PJ) is 1 million gigajoules (GJ) or 277.8 gigawatt hours (GWh).

Image P1.1: Examples of energy use equating to 1 petajoule (PJ)

Notes:

1 Based on the average home using about 5.6MWh of electricity per year in 2022–23.

2 Based on a typical 3-star 400L fridge using 250kWh of electricity per year.

3 Based on a 55-inch, 6-star label television using 240kWh of electricity per year.

4 Based on a car consuming 7 litres of unleaded petrol per 100 kilometres.

Energy in NSW

NSW has the largest economy, population and energy infrastructure estate in Australia.

This means we generate and use more energy than almost any other state in Australia. Queensland uses just a little more. Energy use in NSW accounts for about 25% of Australia's energy consumption.

Electricity versus energy

- Electricity is a type of energy, but there are also other sources of energy.

- Often the terms ‘energy’ and ‘electricity’ are used interchangeably. This is understandable given that we, as domestic consumers, mainly use electricity as the energy source in our homes.

- Currently, fossil fuels such as coal and gas (and other combustible materials) are burned to produce some of our electricity.

- The share of renewable generation (such as solar and wind) in the electricity mix is increasing. As this trend continues, electricity will increasingly form part of more energy use.

- Many industrial processes need a huge amount of heat. These processes currently use fossil fuels to produce that heat.

NSW consumed 1,439 petajoules (PJ) of primary energy in 2022–23 across all the different sectors of the economy.

In 2022–23, the overall mix of primary energy sources used in NSW was oil (44.3%), coal (36.9%), gas (9.7%) and renewable energy (10.0%).

Primary energy refers to the raw source of energy, such as coal, wood, and petroleum products, like oil and gas. Final energy, such as electricity, is the energy that is delivered to and used by end consumers after it has been converted from its primary form.

In 2022–23, petroleum products were mostly consumed by the transport (475PJ) and industrial (121PJ) sectors. Combined, this represented 56.2% of final energy consumption. The total final energy consumption for NSW in 2022–23 was 1,089PJ (Figure P1.2).

Other final energy consumed across the economy includes electricity from coal and gas (19.4%), natural gas (10.2%), coal (7.1%) and renewables (7.1%) ().

In 2022–23, about 34% of NSW electricity generation came from renewable sources. This included 18.6% from large-scale solar and rooftop solar photovoltaics 8.5% from wind power stations and 5.1% from hydro power stations.

Energy framework in NSW

The energy framework is a system of laws, policies, and regulatory bodies that govern the production, distribution and regulation of energy in NSW, including electricity, gas and renewable energy initiatives. Energy is managed by both state and national bodies in NSW.

NSW is part of the National Electricity Market (NEM). This is a system that allows electricity to flow, and be traded, across regions in Australia.

The NEM is underpinned by the National Electricity Law (National Electricity (NSW) Law No 20a 1997) and National Electricity Rules.

It is supported by energy market bodies, including the:

- Australian Energy Market Commission (AEMC)

- Australian Energy Market Operator (AEMO)

- Australian Energy Regulator (AER).

The NSW Independent Pricing and Regulatory Tribunal oversees the safety and reliability of the electricity transmission and distribution network in NSW.

Gas remains an important part of the energy mix in NSW. The operation of gas pipelines, supply and distribution to gas consumers in NSW is regulated by state legislation.

NSW is part of the East Coast Gas Market in which the wholesale gas market is governed by uniform legislation established under the National Gas Law and National Gas Rules.

This legislative framework is supported by the work of the AEMC, AEMO, AER and Australian Competition and Consumer Commission (ACCC). All these bodies play a role in promoting the efficient operation of gas markets in NSW.

The NSW Department of Climate Change, Energy, the Environment and Water (NSW DCCEEW) is driving the transition to renewable energy.

NSW DCCEEW is also responsible for the legislation and policies discussed in Table P1.1.

Table P1.1: Current key legislation and policies relevant to energy

| Legislation or policy | Role |

|---|---|

| Electricity Infrastructure Investment Act 2020 | Sets out the NSW Government’s plan to decarbonise its electricity system. That is, eliminating or reducing carbon emissions as much as possible. |

| Electricity Supply Act 1995 | Regulates the supply of electricity in the retail market, the functions of those engaged in the conveyance and supply of electricity and the management of electricity supply emergencies. |

| Energy and Utilities Administration Act 1987 | Establishes the Energy Corporation of NSW (EnergyCo), which is responsible for delivering the Electricity Infrastructure Roadmap and Renewable Energy Zones. |

| Energy Security Corporation Act 2024 | Establishes the Energy Security Corporation, seeded with $1 billion of capital, to co-invest with the private sector in clean energy technologies to accelerate the State's energy transition. |

| Gas Supply Act 1996 | Regulates the supply and distribution of gas in NSW, ensuring safety, reliability and fair pricing for consumers. |

| Pipelines Act 1967 | Regulates the construction, operation and maintenance of pipelines in NSW, ensuring safety, environmental protection and proper land use management. |

| Electricity Infrastructure Roadmap | Outlines a 20-year plan to integrate renewable energy into the energy-generation mix in NSW. The main goals are to replace coal-fired generators, enhance energy reliability and lower prices by establishing Renewable Energy Zones. |

| Energy Security Safeguard | Helps ensure the NSW energy system is more reliable, affordable and sustainable. It contains three schemes: Energy Savings Scheme, Peak Demand Reduction Scheme and Renewable Fuel Scheme. |

| Net Zero Plan Stage 1: 2020–2030 | Outlines policies and actions for NSW to achieve net-zero emissions by 2030. |

| NSW Electric Vehicle Strategy | Sets out the NSW Government’s plan to accelerate the State’s uptake of electric vehicles. |

| NSW Hydrogen Strategy | Sets out the vision and path for developing a green hydrogen industry in NSW. |

Notes:

See the Responses section for more information about how is being addressed in NSW.

The NSW energy institutional framework is also supported by the bodies listed in Table P1.2.

Table P1.2: Additional energy framework supports in NSW

| Body | Role |

|---|---|

| Australian Energy Regulator | Enforces the laws for the National Electricity Market, selected gas markets, and the retail energy market. It also sets prices for the use of energy networks and the maximum price that retailers can charge electricity on standing offer contracts (the Default Market Officer). It also undertakes a number of regulatory functions under the Electricity Infrastructure Investment Act 2020 in relation to Renewable Energy Zones. |

| Consumer Trustee (AEMO Services Limited) | Independently issues a 10-year Tender Plan and 20-year Development Pathway and runs competitive processes for the timely construction of energy generation, long duration storage and firming infrastructure to meet legislated objectives in the long-term financial interests of electricity. |

| EnergyCo | The Energy Corporation (EnergyCo) of NSW is a statutory authority established under the Energy Utilities and Administration Act 1987 and is responsible for leading the delivery of Renewable Energy Zones. |

| Energy Security Target Monitor | Calculates and sets a 10-year energy security target for NSW to ensure there will be a reliable supply of electricity available to meet electricity demands over the medium term. |

| Independent Pricing and Regulatory Tribunal | Helps NSW residents get energy services at a fair price. Regulates the Energy Security Safeguard schemes. It also provides certain regulator functions under the Electricity Infrastructure Investment Act 2020. |

| NSW Electricity Infrastructure Jobs Advocate | Advises the Minister for Energy on strategies and incentives to encourage investment, workforce development, employment, education and training in the energy sector. It also advises on road, rail and port infrastructure required to promote export opportunities for generation, storage and network technology. |

| Renewable Energy Sector Board | Helps make sure local workers, communities and industries share in the economic benefits of the transition to renewable energy. |

Notes:

See the Responses section for more information about how is being addressed in NSW.

Related topics: | | | |

Status and trends

Energy indicators

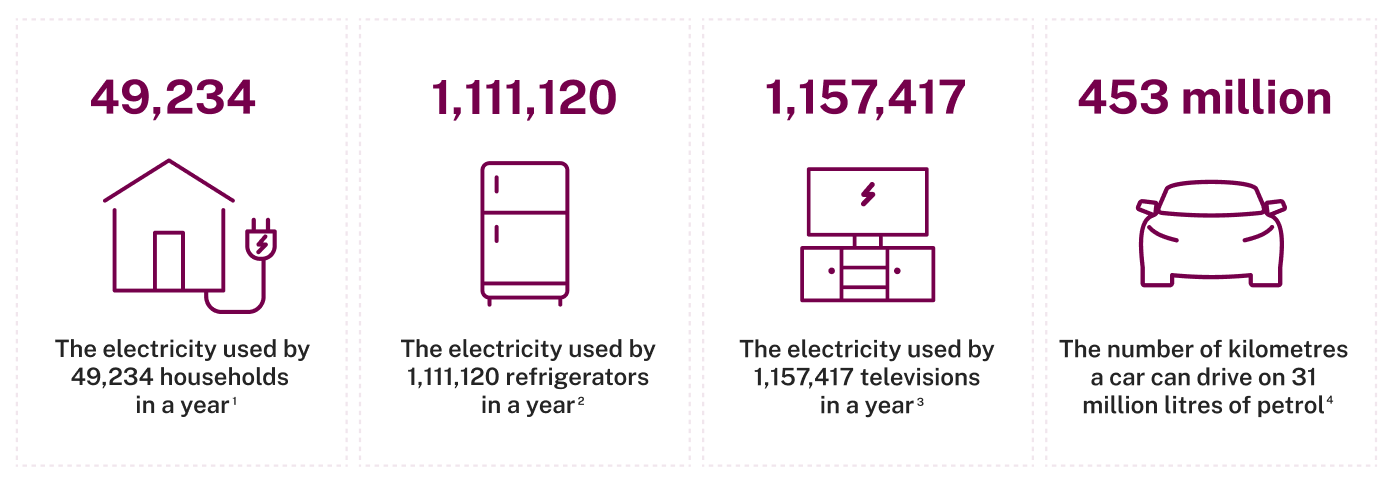

Four indicators are used to assess the state of energy in NSW (see Table P1.3). They are:

- Total NSW non-renewable energy consumption: declined by 14.6% to a total of 66.4% between 2019–20 to 2022–23 (see Energy use by fuel type and sector).

- Transport sector use of non-renewable energy: increased to 483PJ in 2022–23 (see Final energy use by sector).

- Renewable electricity generation in NSW: increased by 4% to a total of 33.6%, between 2021–22 to 2022–23 (see Renewable energy generation).

- Per capita residential energy consumption: declined by 1.4GJ between 2011–12 and 2022–23 (see Per capita energy consumption).

Table P1.3: Energy consumption indicators

| Indicator | Environmental status | Environmental trend | Information reliability |

|---|---|---|---|

| Total NSW non-renewable energy consumption | Stable | Good | |

| Transport sector use of non-renewable energy | Stable | Good | |

| Renewable electricity generation in NSW | Getting better | Good | |

| Per capita residential energy consumption | Stable | Good |

Notes:

NSW includes ACT as source data cannot be disaggregated.

Indicator table scales:

- Environmental status: Good, moderate, poor, unknown

- Environmental trend: Getting better, stable, getting worse

- Information reliability: Good, reasonable, limited.

See to learn how terms and symbols are defined.

Energy use by fuel type and sector

Primary energy refers to energy in its natural, unprocessed form before it is converted or transformed for use.

Figure P1.1 shows that primary energy consumption has decreased since 2008–09 across all fuel types (coal, oil, gas and renewables). In 2008–09, total primary energy consumption was 1,594PJ and 1,439PJ in 2022–23.

Improvements in energy efficiency across industries and households have contributed to a reduction in overall energy demand.

Figure P1.1: Primary energy consumption by fuel type in NSW, 2008–09 to 2022–23

Notes:

Total net energy consumption is the total quantity (in energy units) of primary and derived fuels consumed less the quantity of derived fuels produced.

Petroleum products (final energy) are derived from oil (primary energy).

Final energy is the energy that is delivered to and used by end consumers after it has been converted from its primary form.

Figure P1.2 shows final energy consumption by sector and fuel type (petroleum, electricity, gas, coal and renewable sources) in NSW and the ACT in 2022–23.

In 2022–23, petroleum accounted for about 56.2% of final energy used. Transport sector was the major user of petroleum (475PJ), followed by the industrial sector (121PJ).

Electricity use increased to 19.4% of energy used. Total electricity use has increased slightly (213PJ in 2022–23 versus 204PJ in 2018–19). This may largely be due to population growth.

Renewable energy use in final consumption remained the same, at 78PJ, between 2018–19 and 2022–23. This largely represents the use of biomass (organic matter), wind, solar and hydroelectric power.

In 2022–23, coal use accounted for about 7.1% of consumption. Natural gas use was 10.2% (excluding coal and gas used for electricity generation).

The industrial sector is one of the main users of coal (along with coal to generate electricity). Coal is used to generate heat as part of manufacturing processes. Total coal use by the industrial sector declined from 126PJ in 2015–16 to 78PJ in 2022–23.

The industrial sector is also the largest user of gas, mostly as a raw material input. Total use of gas stayed flat at 112PJ between 2018–19 to 2022–23.

Figure P1.2: Final energy consumption for each sector by fuel type in NSW and the ACT, 2022–23

Notes:

Data re-analysed by NSW Department of Climate Change, Environment, Energy and Water to avoid double-counting and better allocate energy use to sectors.

Final consumption figures exclude waste heat losses in power plant facilities, conversion losses in refineries and network losses from the transmission of electricity over long distances.

Consumption by the electricity generation sector is not shown.

Coal consumption figures exclude coal inputs to electricity generation.

Natural gas consumption figures exclude gas inputs to electricity generation.

Renewable energy figures quoted include biomass (including biofuels), solar and hydroelectricity.

Industrial energy consumption excludes coal by-products.

Reported sub-category changes between versions of Australian Energy Statistics Table F means that calculated chart data is lower than in State of the Environment 2018.

Final energy use by sector

Energy consumption in NSW and the ACT rose from the early 1990s until 2010. This was followed by a subsequent decline over the next decade, with minor fluctuations.

Final energy consumption decreased by about 5.6% in the last decade, from 1,163PJ in 2013–14 to 1,038PJ in 2022–23, with a small increase in the past 3 years.

Figure P1.3 shows the trends in final energy consumed per sector for the NSW and ACT economies.

Figure P1.3: Final energy consumption by sector in NSW and the ACT, 1993–94 to 2022–23

Notes:

Data is shown for NSW plus the ACT, as source data cannot be disaggregated.

Industrial sector includes agriculture, mining and manufacturing.

Commercial sector includes general commercial, construction and water, sewerage and drainage industries.

In the period 1993–94 to 2022–23, energy consumption by the:

- transport sector increased steadily, from 357 to 487PJ

- industrial sector fell from 440 to 354PJ

- residential sector increased from 106 to 144PJ

- commercial sector almost doubled from 60 to 112PJ.

In 2022–23, the transport sector continued to be the highest energy user (44.3% of the total), compared to the industrial sector (32.3%), residential sector (13.1%) and commercial sector (10.3%).

In comparison, in 2013–14 the energy share of transport was 43.9%.

Transport’s share of energy use has increased from last financial year. This may be due to post COVID-19 increased travel. However, this is uncertain and further data and analysis are needed to make that determination.

Per capita energy consumption

Between 2011–12 and 2022–23, increases in energy efficiency and changes in usage patterns have offset the increase of the NSW population. This has allowed our total consumption per capita of energy to decrease slightly (see Table P1.4).

Table P1.4: Energy consumption in NSW and the ACT, 2011–12 to 2022–23

| Financial year | Population | Consumption (PJ) | Per capita consumption (GJ) | Residential consumption (PJ) | Per capita residential consumption (GJ) |

|---|---|---|---|---|---|

| 2011–12 | 7.6 | 1,189.8 | 155.9 | 135.5 | 17.8 |

| 2012–13 | 7.7 | 1,188.1 | 153.7 | 135.3 | 17.5 |

| 2013–14 | 7.8 | 1,163.2 | 148.4 | 134.9 | 17.2 |

| 2014–15 | 8.0 | 1,135.4 | 142.8 | 130.2 | 16.4 |

| 2015–16 | 8.1 | 1,137.0 | 140.9 | 129.9 | 16.1 |

| 2016–17 | 8.2 | 1,150.0 | 140.1 | 133.1 | 16.2 |

| 2017–18 | 8.3 | 1,169.8 | 140.3 | 132.8 | 15.9 |

| 2018–19 | 8.5 | 1,160.0 | 137.1 | 134.0 | 15.8 |

| 2019–20 | 8.6 | 1,102.5 | 128.8 | 135.8 | 15.9 |

| 2020–21 | 8.6 | 1,051.0 | 122.9 | 138.6 | 16.2 |

| 2021–22 | 8.6 | 1,037.9 | 120.4 | 146.3 | 17.0 |

| 2022–23 | 8.8 | 1,098.0 | 124.8 | 144.2 | 16.4 |

Residential consumption per capita also includes residential solar generation. Residential electricity generated may be exported to the wider grid as well as consumed by households.

Between 2011–12 and 2022–23, the population of NSW increased by more than 12% or about a million people.

Over the same period, per capita energy consumption fell about 16%, with total and residential energy consumption decreasing by about 5%. The sudden increase in residential consumption between 2020–21 to 2021–22, is most likely due to COVID-19 related lifestyle changes. With more people working from home, it means greater likelihood of household appliances, heating and cooling systems being in regular use.

Between 2020–21 to 2022–23, per capita energy consumption has increased by 2%, but remains below previous highs.

Electricity demand and electrification

In the past 15 years (2008–23), annual demand for electricity from the NSW grid has declined by more than 14,000 gigawatt hours. This is the equivalent of about 18% of total electricity demand in the period.

The reduced demand was primarily driven by energy efficiency measures and the strong uptake of behind-the-meter rooftop solar.

Electricity consumption is forecast to increase significantly in coming years. This will be the result of population growth, commercial and industrial electrification, and the uptake of electric vehicles.

There are two drivers for this predicted increase:

- It is often now cheaper and more efficient to use electricity rather than other forms of energy. More consumers will switch to electricity as technologies, such as electric vehicles, heat pumps for air and water heating, and induction cookers become more common and affordable.

- The electricity system is transforming into one that is cheap, clean and reliable. This means that electrification will support the achievement of the State’s emissions reduction targets.

Clean electricity, generated from renewable sources, such as solar and wind means we can phase out burning fossil fuels to generate electricity. Electricity can be used as a replacement for other fuels in places like:

- transport via electric vehicles

- heating and cooling via efficient electric heat pumps

- industrial heating via electric furnaces.

Electrification is already starting to take place in households and industries and is expected to accelerate.

The size of the increase will depend on how fast these changes occur (see Figure P1.4).

The only forecast scenario where electricity demand might not increase in the short term is the 'progressive change' scenario where the Tomago aluminium smelter is assumed to close in 2029. This smelter is the largest electricity user in NSW.

Figure P1.4: Historical and forecast grid electricity consumption in NSW and the ACT, 2000–2053

Notes:

Data is shown for NSW plus the ACT, as source data cannot be disaggregated.

For information on forecasting scenarios, refer to the Australian Energy Market Operator (AEMO) 2023–24 Inputs, Assumptions and Scenarios Report (AEMO 2023).

Actual change: This is the real electricity demand in the period.

Step change: This is the most likely scenario. Key drivers are growth in electrification of business, residential and transport sectors; continued uptake of Consumer Energy Resources including distributed photovoltaics; and emerging hydrogen production for primarily domestic use.

Green energy exports: This scenario reflects very strong decarbonisation activities. These include strong use of electrification and development of green hydrogen exports and biomethane. They would cause a large increase in electricity demand.

Progressive change: This is the slowest scenario to meet Australia’s current Paris Agreement commitment. It closely follows the 'step change' scenario until 2030. Factors that slow it down include slower electrification and electric vehicle uptake and lower hydrogen production. This scenario also includes large industrial load closures, including Tomago in 2029–30.

Renewable energy generation

In 2022–23, renewable fuel sources provided about 34% of the State’s total electricity generation. That is more than three times what they provided in 2013–14 (see Figure P1.5).

Figure P1.5 does not include energy supplied by household solar hot water heating. In 2021–22, that energy provided an estimated supply of about 4.9PJ. That is equivalent to 1,361GWh.

Figure P1.5: Renewable fuel sources for NSW electricity, 2008–09 to 2022–23

Between 2013–14 and 2022–23, wind generation grew from 899GWh to 6,211GWh. Over the same period, solar photovoltaic generation increased from 975GWh to 7,498GWh.

In 2022–23, combined wind and solar photovoltaic generation exceeded 17,300GWh. It supplied almost 27% of the State’s total electricity demand.

Bioenergy generation (burning of plants, biogas and other organic material) has declined slightly since the State of the Environment 2021.

Bioenergy electricity sources include bagasse (sugar cane waste) and landfill gas. In 2022–23, bioenergy sources generated 992GWh of electricity. In 2020–21, they generated 1,097GWh.

Cost of renewable energy

Renewable energy comes from natural sources, such as sunlight and wind, which are naturally occurring unlimited resources.

Renewable energy is crucial for reducing pollution and combating climate change, as it helps lower greenhouse gas emissions and lessens reliance on expensive fossil fuels.

Embracing renewable energy also supports a cleaner, more sustainable environment for the future.

Renewable generation costs have decreased over time due to improvements in:

- technology

- efficiency

- supply chains

- workforce skills.

When combined with very low operating costs, renewable generation has become more cost-effective than fossil fuel-generated sources.

The levelised cost of electricity is a measure of the average cost of electricity produced by a generator over its lifetime.

According to the most recent CSIRO GenCost 2023–24 report, the levelised cost of electricity cost range for variable renewable energy (solar photovoltaics and wind) with integration costs is the lowest of all new-build technologies in 2023 and 2030. The cost range overlaps with the lower end of the cost range for existing (sunk cost) coal and gas generation.

Looking ahead, the prices for renewable energy are forecast to continue falling (). In contrast, the cost of coal is expected to remain stable or gradually increase due to ongoing power station maintenance expenses. This trend underscores the continuing economic viability of renewable energy sources over traditional fossil fuel generation.

Pressures and impacts

Climate change

Globally, it is expected that climate change will result in higher energy consumption by 7–17% by 2050, driven in part by increased demand for cooling ().

In NSW, it is less clear what impact climate change will have on energy consumption.

Warmer temperatures in winter months will lead to lower heating requirements for households and businesses.

In summer months, higher temperatures are expected to lead to greater cooling demand.

In NSW, the days when people need to run cooling technologies (such as air conditioners) are the peak demand days and when the most electricity is used.

Climate change may mean that the maximum amount of electricity we use on any given summer day will increase over time.

Climate change concerns are also leading to a fundamental reshaping of energy demand in non-electricity sectors, such as transport and heavy industry.

The move to electrified transportation and industrial processes will shift energy demand in these sectors from largely fossil fuel and petroleum-based to electricity.

There will be increases in electricity demand due to climate change, population growth and sectoral transitions. This underscores the importance of an increased focus on energy demand-side measures to accompany new renewable electricity generation.

For example, measures can include energy efficiency improvements, smart metering and time of use pricing. This minimises peak-demand pressures on the electricity system.

Transport and fuel demand

Transport is the second largest source of emissions, especially from motor vehicles, which are a major source of air pollution, particularly in urban areas.

Public transport, including trains and buses, offers a more efficient and lower-emission alternative to private vehicles. Public transport plays a crucial role in reducing overall transport emissions.

Rail infrastructure is also key in transporting bulk goods over long distances. This supports more sustainable practices and reduces dependence on road transport. Despite this, trucking remains dominant due to its versatility and ability to access locations without a rail line.

Most vehicles in NSW are fuelled by petrol or diesel. Under the Biofuels Act 2007, the State has set targets for 6% of petrol and 2% of diesel sold to come from ethanol and biodiesel, respectively.

Fuel efficiency standards are set by the Australian Government. These standards will be further strengthened with the New Vehicle Efficiency Standard, which is proposed to begin on 1 January 2025.

The growing availability and affordability of electric vehicles present an opportunity to increase the use of renewable energy in the transport sector.

Electric vehicle adoption continues to rise. Battery electric vehicles comprised 7.2% of new Australian passenger vehicle sales in 2023 ().

See the topic for more information on electric vehicles in NSW.

Infrastructure transition

As NSW moves away from reliance on fossil fuels, supporting measures must be implemented to respond to exiting coal-fired generation. These measures are needed to ensure the integrity and reliability of the grid while renewable sources and transmission capacity come online ().

Coal-fired power stations were a reliable source of power for many generations but are now ageing and scheduled to close. They are expensive to operate and maintain, and have become less reliable. This increases the price we pay for electricity.

As coal-fired power stations close for good, we need to be ready to meet our future energy needs.

Three out of the four coal-fired power stations, supplying about two-thirds of the State’s electricity, are scheduled to close by 2033. The first closure will be Eraring power station. It is NSW’s largest coal-fired power station, supplying 18% of the State’s current electricity needs. It is set to close in mid-2027.

The stations set to close are being replaced by renewable energy sources. These include sources developed under the NSW Electricity Infrastructure Roadmap.

The transition to renewable energy sources is well underway.

NSW has abundant solar and wind resources. These natural advantages are being harnessed.

Firmed renewables have replaced coal as the most affordable source of new build electricity.

A firmed renewable is a renewable electricity source (such as solar or wind) that is backed by storage (such as a battery) to ensure consistent and reliable electricity supply.

More people are installing systems to return energy to the grid. Electric vehicle uptake is forecast to increase. The profile for electricity use is changing.

So too is the way battery storage is used. Increasing support or adaptation is needed for the changes in these systems as the electricity grid was originally designed to operate as a one-way power-delivery system with large energy generators, such as coal-fired power stations, delivered electricity via poles and wires to homes and businesses.

As population expands, so does the demand for housing, transportation and services, driving-up electricity usage.

To meet the growing demand, investment in renewable electricity, energy efficiency measures and grid modernisation must continue to develop.

Some concern remains about whether the existing electricity infrastructure can cope with the added energy sources. For example, it could be a challenge to integrate large amounts of residential solar and battery systems into a network that was not built to support it. A variety of solutions, such as community batteries, demand management and time-of-day charging, are being explored to manage this potential risk.

See the Moving away from fossil fuels section of this topic for more information.

Responses

Responding to a changing climate

The NSW Climate Change Policy Framework guides the NSW Government’s policy and programs to achieve the State’s objectives to:

- achieve net-zero emissions by 2050

- make NSW more resilient to a changing climate.

The NSW Net Zero Plan builds on the framework by supporting a range of initiatives to reduce emissions from energy consumption. These initiatives include the:

- NSW Electricity Infrastructure Roadmap

- NSW Electric Vehicle Strategy

- NSW Hydrogen Strategy

- NSW Net Zero Industry and Innovation Program.

See the Net Zero Plan Stage 1: 2020–2030 topic for more information on these initiatives.

The NSW Climate Change (Net Zero Futures) Act 2023 was passed in November 2023. It puts the framework objectives into legislation

The Act sets a clear path to net zero by enshrining three emission reduction targets:

- a 50% emissions reduction on 2005 levels by 2030

- a 70% emissions reduction on 2005 levels by 2035

- net zero emissions by 2050.

The decarbonisation of energy across all sectors – particularly electricity, transport and heavy industry – will be the biggest driver to meeting the State’s emissions-reduction commitments.

The framework’s adaptation objective supports efforts to reduce energy consumption. It does this by working to ensure actions to adapt to climate change support the State’s emissions-reduction targets, rather than conflict with them.

An example of this could be managing the impacts of extreme heat through passive design measures. This could have the co-benefit of minimising peak-demand pressures and electricity consumption.

The Electricity Infrastructure Roadmap

The NSW Government's Electricity Infrastructure Roadmap is delivering the power network the State needs now and in the future. The upgrades will deliver more clean, affordable and reliable electricity.

As it steadily moves away from coal, NSW will be powered by a mix of renewable technologies. These include:

- rooftop solar

- household batteries

- solar and wind projects

- large-scale electricity storage, such as pumped hydro and big batteries.

Released in 2020, the roadmap is a 20-year plan supporting the delivery of at least 12GW of new renewable electricity generation and two gigawatts and 16GWh of long-duration storage by 2030.

Planning and coordination of energy infrastructure roll out

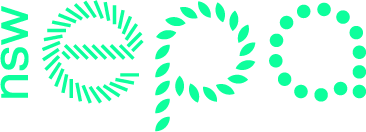

One of the cornerstones of the roadmap is the delivery of at least five Renewable Energy Zones (REZs) across NSW.

REZs have been selected for their abundant renewable energy resources.

REZs combine:

- renewable energy generation, such as wind and solar

- storage, such as batteries

- network infrastructure, such as high-voltage poles and wires.

Five REZs have been declared: Central-West Orana, New England, Hunter–Central Coast, South West and Illawarra.

The Energy Corporation of NSW (EnergyCo) has been appointed as Infrastructure Planner to coordinate the delivery of the REZs (see Map P1.1).

Map P1.1: NSW Renewable Energy Zone locations

Transmission is a critical enabler for:

- modernising the energy grid

- transporting clean, renewable energy from generating and storage assets, from load centres and across jurisdictions.

Projects such as Hunter Transmission Project, HumeLink and Project EnergyConnect will play a key role in improving the State’s transmission capacity.

The NSW Network Infrastructure Strategy and the Infrastructure Investment Objectives Report seek to coordinate the development of the State’s electricity infrastructure. This includes transmission options.

The NSW Government is building supporting infrastructure to modernise the electricity grid with batteries around the State. These include the Waratah Super Battery. This is a backup electricity storage system. It is designed to act as a ‘shock absorber’ in the event of sudden power surges. These power surges may be caused by bushfires or lightning strikes, for example.

Moving away from fossil fuels

In response to the transition away from fossil fuels, the NSW Government is leading the development of the Orderly Exit Management Framework. It is doing this on behalf of the Energy and Climate Change Ministerial Council.

The objective of the framework is to ensure an orderly energy market transition. This will be achieved by ensuring that scheduled thermal generators are not retired before replacement infrastructure is in place.

Gas

Nearly all Australian gas is exported, which occasionally leaves insufficient supply for Australia.

During the energy transition, gas may play a role in firming the electricity grid and providing an energy source in sectors that are hard to abate ().

Gas faces strong competition from batteries, pumped hydro, demand management and time-of-use tariffs.

The State’s demand for gas is projected to decline. The decline in gas demand will not match the decline in gas supply for the entire East Coast Gas Market. Shortfalls are projected from 2025 ().

Energy Ministers across jurisdictions have agreed to national reforms, including providing additional powers to energy market bodies to manage gas supply adequacy and reliability risks.

The reforms are supported by a Gas Code of Conduct and Heads of Agreement between the Australian Government and liquefied natural gas exporters. These create measures to supply the domestic Australian gas market before exporting.

Alternative fuels

The NSW Government is considering options for supporting the development and use of other renewable fuels in NSW.

The Sustainable Aviation Fuel Prospectus outlines the opportunities that a sustainable fuel aviation fuel industry could bring to NSW.

Hydrogen

The NSW Hydrogen Strategy was released in 2021. It sets out the pathway to becoming a global leader in green hydrogen.

Implementation of the strategy is underway. It provides up to $3 billion of incentives through 60 industry development actions. These actions recognise the critical role of hydrogen in decarbonising sectors that are hard to abate and serves as the building blocks for many renewable fuels.

Key actions of the strategy include the NSW hydrogen hubs initiative and production incentives.

NSW hydrogen hubs initiative

The NSW Government has awarded $109 million of grant funding to three hydrogen hub projects. With an anticipated production capacity of 700 megawatts by 2030, these hubs are critical to decarbonising emissions-intensive industries. These industries are mostly in the chemicals sector, such as ammonia and metals.

Production incentives

Producers can sell green hydrogen at a lower cost by taking advantage of a range of electricity concessions and the Renewable Fuel Scheme. These incentives are intended to significantly reduce the cost of green hydrogen production.

The NSW Decarb Hub

Established in June 2022, the NSW Decarb Hub supports the Net Zero Plan. Funding from the NSW Government through the Office of the Chief Scientist and Engineer and the NSW Environmental Trust, the hub is co-hosted by the University of NSW and the University of Newcastle. It is supported by other leading universities across NSW.

The hub supports and accelerates the Net Zero Plan by facilitating and supporting projects within its three networks:

- Land and Primary Industries

- Electrification and Energy Systems

- Powerfuels, including Hydrogen.

Acting on local community needs

Renewable Energy Sector Board

The Renewable Energy Sector Board was established in February 2021 under the Electricity Infrastructure Investment Act 2020.

The board helps make sure local workers, communities and industries share in the economic benefits of the transition to a more affordable, clean and reliable electricity system.

The board has developed a plan for the NSW renewable energy sector to achieve objectives for the construction of generation, storage and network infrastructure in a cost-effective way. These objectives include:

- the use of locally produced and supplied goods and services

- employment of suitably qualified local workers

- opportunities for apprentices and trainees.

The board also advises the Minister for Energy and Electricity Infrastructure Roadmap-delivery entities on how to support:

- the growth and competitiveness of the NSW renewable energy sector

- jobs for NSW workers.

Workforce for the energy transition

Australia’s energy transition is gaining pace. This means it is crucial to have a sufficiently large and skilled workforce.

The Australian Electricity Workforce for the 2022 Integrated System Plan: Projections to 2050 is reported by the Institute for Sustainable Futures and Australian Energy Market Operator and funded by Reliable, Affordable, Clean Energy (RACE) for 2030.

The report estimates the workforce needed for this transformation.

It offers projections across various scenarios, including Australia’s potential as a renewable energy exporter and the impact of offshore-wind targets.

The report also provides guidance on workforce development to maximise regional and national benefits, stabilise the industry and support effective policy making.

Engaging with Aboriginal communities

The NSW Government is committed to genuine and meaningful engagement with local Aboriginal communities in the implementation of the Electricity Infrastructure Roadmap.

The First Nations Guidelines set out the expectations for consultation and negotiation with local Aboriginal communities and their aspirations for increasing employment and income opportunities in the construction and operation of new electricity infrastructure projects under the roadmap.

There are two parts to the guidelines: general guidelines and region-specific guidelines:

- General guidelines provide information about best practice engagement with local Aboriginal communities.

- Region-specific guidelines support the general guidelines for each of the five Renewable Energy Zones.

Each region-specific guideline is co-developed with representatives from the local Aboriginal communities, with assistance from Aboriginal consultants, to ensure that:

- engagement and consultation are culturally appropriate

- content is community driven and relevant to the needs and opportunities of the region’s Aboriginal people and businesses.

Supporting farmers to transition to renewables

The NSW Renewable Energy and Transmission Landholder Guide has been developed to help landholders understand and navigate the transition to renewable energy. The guide includes information and guidance for landowners who are considering hosting wind, solar or battery projects. It addresses topics such as:

- negotiating agreements with renewable energy developers

- the processes involved in setting up projects

- understanding long-term farm impacts

- securing fair compensation

- managing land use restrictions

- addressing construction disruptions and ongoing project impacts.

Monitoring the needs of the energy system

The NSW Government has appointed the Australian Energy Market Operator (AEMO) as the Energy Security Target Monitor under the Electricity Infrastructure Investment Act 2020.

Under the appointment, the AEMO's role is to calculate and set a 10-year energy security target for NSW. This ensures there will be a reliable supply of electricity that meets demand.

The AEMO is also responsible for assessing and monitoring whether the firm capacity (generation, firming and storage and transmission capacity) is sufficient to meet the energy security target under different scenarios.

The Energy Security Target Monitor lets the energy market know how much new infrastructure the NSW Government expects will be required to meet the State’s energy needs.

The Energy Security Target Monitor Report is regularly updated. It shows the amount of reliable electricity needed in NSW to service maximum consumer demand. For example, the report would accommodate a summer heatwave plus a buffer.

Partnerships

Partnering with the private sector

The independent Consumer Trustee is running competitive tenders according to a 10-Year Tender Plan to recommend Long-Term Energy Service Agreements to project developers.

These agreements incentivise construction of enough renewable energy generation, long duration storage and firming infrastructure to meet a 20-Year Development Pathway. The agreements are designed to provide revenue certainty for private investors once operating, which helps secure finance for project construction.

Committed projects and roadmap tenders mean that half of the minimum required 12GW of renewable electricity generation and around a quarter of the 2GW of long-duration storage required by 2030 are locked in.

This investment will bring more renewable electricity into the grid, which will put downward pressure on electricity prices.

Partnership with the private sector is also being facilitated through the establishment of the Energy Security Corporation (ESC). The Energy Security Corporation Act 2024 established the ESC as a state-owned body to co-invest with the private sector to accelerate investment in clean energy projects that improve the reliability, security and sustainability of electricity supply and help NSW meet its emissions reduction targets.

The ESC is intended to make its first investments in 2025–26.

Partnering with the Commonwealth

The NSW Government is partnering with the Commonwealth to deliver the energy transition.

In December 2022, the NSW and Commonwealth Governments announced their Rewiring the Nation deal. The deal is valued at $7.8 billion.

The deal will fast-track eight critical transmission and Renewable Energy Zone projects in NSW. These projects are:

- Sydney Ring – Hunter Transmission Project

- Central-West Orana Renewable Energy Zone

- New England Renewable Energy Zone

- HumeLink

- Victoria to NSW Interconnector West

- Hunter–Central Coast Renewable Energy Zone

- Sydney Ring – Southern Sydney Ring

- South-West Renewable Energy Zone.

Through the Capacity Investment Scheme (CIS), the Australian Government is underwriting up to 23GW of variable renewable energy generation capacity and 9GW of clean dispatchable capacity nationally.

The CIS pilot was delivered in 2023 in partnership with the NSW Electricity Infrastructure Roadmap. The CIS supported an expansion of NSW Roadmap’s Tender 2 for Firming Infrastructure. Originally seeking projects delivering at least 380MW, with CIS support eventually six successful projects were announced capable of dispatching 1,075MW of capacity into the network at short notice. Two projects delivering 480MW of this capacity were supported by the CIS.

On 6 November 2024, the Commonwealth confirmed it would underwrite a further 7.1GW of renewable electricity generation capacity and at least 1.3GW (5.2GWh) of clean dispatchable capacity in NSW through subsequent CIS tenders. Through the tenders the Commonwealth is targeting projects capable of reaching commissioning by 2030 to support the achievement of its target of reaching 82% renewable electricity by 2030.

Delivering this additional capacity in NSW will put downward pressure on wholesale electricity prices, support reliability, and support the achievement of NSW’s legislated targets for delivering renewable energy generation and emissions reductions.

The NSW and Commonwealth Governments are also partnering on measures to address energy affordability.

In January 2024, the Commonwealth and NSW Governments jointly announced a $206 million package to deliver long-term cost-of-living savings to 30,000 NSW households. The package will fund energy-saving upgrades in social housing properties and access to solar for renters and apartment dweller.

This will allow residents to reduce their energy bills.

Partnering with energy consumers

The Energy Savings Scheme provides businesses and households with financial incentives to implement energy-saving activities. The scheme is legislated to run until 2050.

Activities implemented under the scheme between 2009 and 2022 will deliver about 48,000GWh of energy savings and $11.9 billion in energy bill savings by 2033.

Higher energy-saving targets were legislated for the Energy Savings Scheme in 2021.

The Peak Demand Reduction Scheme commenced in 2022 and is legislated to run to 2050. It provides incentives for households and businesses to undertake activities that reduce electricity demand during peak times.

Reducing peak demand improves the reliability and resilience of the energy system as well as affordability.

It is estimated to deliver $1.2 billion in energy bill savings for households and businesses across NSW by 2040.

Future opportunities

Consumer Energy Strategy

The NSW Government released a new Consumer Energy Strategy in 2024.

The goal is to help households and businesses access benefits of energy saving technology, such as household batteries and energy efficient appliances. The strategy will:

- keep energy bills low

- help achieve net zero emissions

- make the energy system more reliable

- ensure everyone can benefit from, and participate in, the energy transition.

Strategic Benefit Payments Scheme

As coal-fired power power stations retire it becomes increasingly critical to build the new electricity infrastructure needed in time to ensure energy security, reliability of supply and affordability.

Under the Strategic Benefit Payments Scheme, private landowners in NSW may receive annual payments for hosting transmission infrastructure associated with certain new major high-voltage transmission projects.

This includes Renewable Energy Zone network infrastructure projects. It also includes priority transmission projects and other transmission projects identified in the Australian Energy Market Operator’s Integrated System Plan.

The payments are a set rate of $200,000 (in real 2022 dollars) per kilometre of transmission hosted. It is paid out in annual instalments over 20 years.

Supporting innovation and employment opportunities

In February 2024, the NSW Government announced $275 million in grants under the Net Zero Manufacturing Initiative. This aims to secure NSW as the place to develop and manufacture clean technology and create new jobs in the process.

As part of the Net Zero Manufacturing Initiative, up to $150 million was made available for renewable manufacturing to increase NSW’s capacity to make the components needed for renewable energy projects. The goal was to alleviate supply chain constraints and increase local content capability.

The initiative will focus on technologies that are already lab proven and the manufacturing of market-ready products that are ready to be scaled up and rolled out across NSW. This will support the State’s five Renewable Energy Zones and hydrogen hubs, giving them access to more materials produced in NSW.

To ensure the energy regulatory framework is fit for purpose for the energy transition, the NSW Government continues to modernise the legislative and regulatory framework for the safety and technical regulation of the gas network and pipelines.

This includes adjusting for future changes in pipeline use, such as transporting hydrogen and other renewable fuels.

Long duration storage

Long-duration storage serves an important role as it allows renewable electricity, such as solar and wind, to be stored and then dispatched when needed for extended periods. When constructed the NSW based Snowy 2.0 (2,200 megawatts and 350,000 megawatt hours) will be one of the largest pumped hydro facilities in the world.

Long Duration Storage technologies are varied and can also include batteries, compressed and liquid air storage and other emerging technologies. For some years now, the Emerging Energy and Pumped Hydro Recoverable Grants Programs have been supporting the commercialisation of Long Duration Storage projects in NSW.

The Electricity Infrastructure Investment Act 2020 takes a technology neutral approach to meeting NSW’s long duration storage needs. Regular competitive tenders for Long-Term Energy Service Agreements are incentivising construction of projects that store electricity that can be dispatched for at least eight hours.

The Consumer Trustee has held two tenders for long duration storage, collectively the projects that have been awarded long term energy service agreements will deliver 4,592 megawatt hours of storage to NSW. Results of a third tender are expected early 2025, and a fourth tender round is expected to open May 2025.

Image source and description

Topic image:Awabakal Country–Newcastle. Photo credit: John Spencer/EPA (2016).Banner image:Topic image sits above Butjin Wanggal Dilly Bag Dance by Worimi artist Gerard Black. It uses symbolism to display an interconnected web and represents the interconnectedness between people and the environment.

Image source and description

Topic image:Awabakal Country–Newcastle. Photo credit: John Spencer/EPA (2016).Banner image:Topic image sits above Butjin Wanggal Dilly Bag Dance by Worimi artist Gerard Black. It uses symbolism to display an interconnected web and represents the interconnectedness between people and the environment.